Q1. What is a mortgage?

Q1. What is a mortgage?

Ans. It is collateral or a security kept by the lender in case of default in the borrower’s payment. It holds borrower at an obligation to pay back the predetermined payments for a certain period of time.

Q2. Does it provide low interest?

Ans. If the lender is providing security for the loans, he will be relaxed in terms of interest rates. This is the paramount reason for an individual to choose a secured loan over an unsecured loan.

Q3. Does the borrower get diversified options for loans?

Ans. If a borrower is planning to go for this loan, his loan options will be highly diversified. A Loan can be given against both commercial as well as residential property. The payments are compensated with the options provided to the borrower.

Q4. Does it provide tax benefits?

Ans. It also aids in saving tax. In the recent budget, government relaxed the tax for the secured loan borrowers by reducing the tax amount by the interest paid on these loans. It sure helps to cut short a lot of costs.

Q5. Does it help in building the credit score?

Q5. Does it help in building the credit score?

Ans. A secured loan in the borrower’s statements can have a huge impact on his scores, and it will always be positive as long as the borrower is sincere in his payments. If it is compared this with any other loan, the impact will be much less.

Q6. Can this provide a huge amount of loan?

Ans. This loan is generally being taken for a huge amount only. This loan provides a large flow of funds to the borrower which can be used for big purchases.

Q7. Is the process of availing it easy?

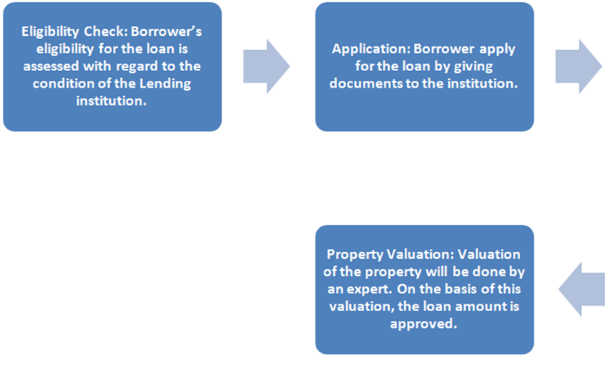

Ans. The process of availing the loan is quite easy and simple. The following flowchart will lead you in the process-

After all these stages, the settlement stage of the loan process is done. The loan amount is finally given to the borrower at this stage.

Q8. What documents are required?

Q8. What documents are required?

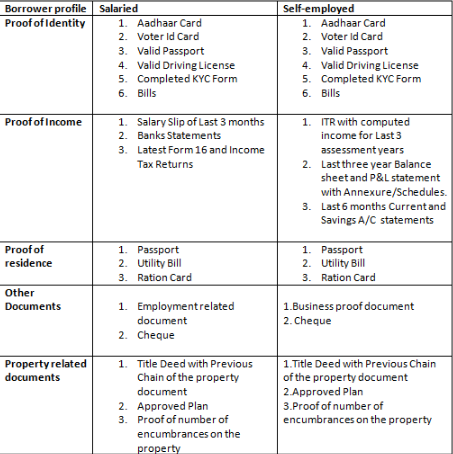

Ans. The list of documents to be required in this process is minimal and basic to the requirements. They are-