Q1. What does it mean?

Ans. It is exactly what the name implies — a loan given against the mortgage of property. This loan is usually given as a certain percentage of the property’s market value, usually around 40 per cent to 60 per cent.

Q2. How does the lending institution decide on the amount I can get as loan?

Ans. Lending institution assesses the applicants’ repayment capacity and the value of property while deciding on the loan eligibility. Repayment capacity is calculated on factors such as applicant and co-applicant’s income, age, number of dependents, financials, banking habits, loan repayment history and business/employment stability. You can read more about the different factors which affect the loan amount here.

Q3. What types of property are considered as a collateral?

Ans. Residential property (Self occupied or vacant), commercial property (Offices, Shops etc.), industrial property (occupied) and also alternate properties (Schools, Hospitals, Hotels etc) can be considered as collateral. Read more about the different types of properties which can be used as collateral here.

Q4. Who are eligible to be co-applicant?

Q4. Who are eligible to be co-applicant?

Ans. Please refer to following Table for Co-Applicant criteria:

| Ownership | Income Aggregation | Result |

| Husband | Wife | Yes |

| Wife | Husband | Yes |

| Father/Mother | Son | Yes, if sole child |

| Son | Father/Mother | No |

| Father + Son | Father/Son/Both | Yes |

| Father/Mother | Daughter | No |

| Daughter | Father/Mother | No |

| Brother/Sister | Brother/Sister | No |

| Mother + Son | Mother/Son/Both | Yes |

| Brother 1 | Brother 2 | No |

| Brother 2 | Brother1 | No |

| Brother 1 + Brother 2 | Brother1 + Brother 2 | Yes, if separable units |

| Individual(s) | Company | No |

| All partners are owner of property | Partnership Firm | Yes |

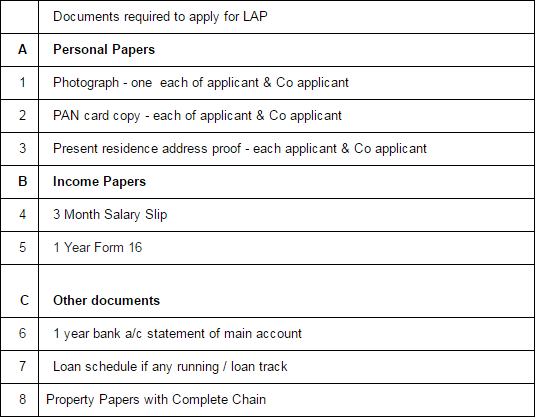

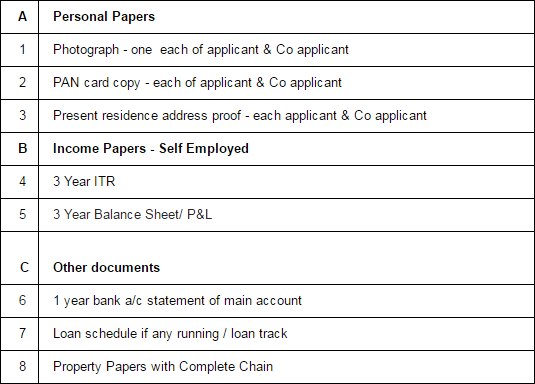

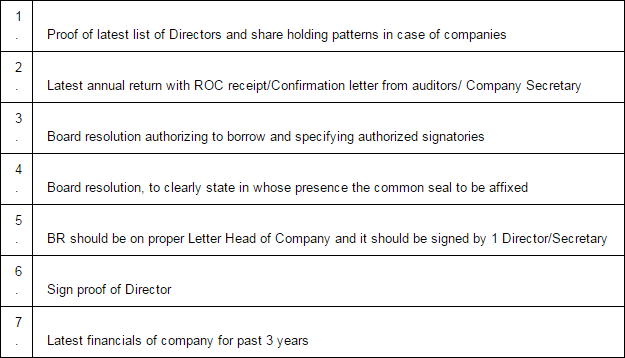

Q5. What documents are required?

Ans. Documents required for salaried cases are :

Documents required for Self-Employed cases are:

Documents required for Companies are:

Q6. Is the interest rate fixed or floating?

Ans. Financial institution offers both fixed as well as floating interest rates. Generally, for larger loans floating interest rates is preferred.

Q7. What is the tenure of the loan?

Ans. Loans against property has a maximum tenure of 15 years, subject to the condition it does not exceed retirement age for salaried individuals or 65 years for self-employed. This condition however, can be flexible in certain cases.

Q8. How to repay my loan?

Ans. You repay the loan in Equated Monthly Installments (EMIs) comprises of principal and interest. Repayment by way of EMI commences from next month in which you take full disbursement.

Q9. Can I prepay my loan?

Ans. Yes, you can prepay your outstanding loan amount in parts or in full. Prepayment charges as applicable may be levied on the outstanding loan amount by lending institution.

Q10. How is the security created?

Q10. How is the security created?

Ans. This mortgage is Equitable mortgage created by deposit of title deeds and Memorandum of Entry. Additional security by way of assignment of insurance policy or any such other assignable financial instruments are also required, if deemed necessary by the bank.

Title of the property should be clear, marketable and free from encumbrance. To elaborate, there should not be any existing mortgage or loan which is likely to affect the title to the property adversely.