You should congratulate yourself if you are reading this article for investing your money. Investing is one habit that would always give huge rewards to you in future. Investing can be started with any amount of money in your hand and an early start to investment is always desirable. You can start your investment by investing a small investment like 50,000. In this article, we would focus on how can you get return from your short term investment in a smart way by looking at the best short term investment options available to you-

You should congratulate yourself if you are reading this article for investing your money. Investing is one habit that would always give huge rewards to you in future. Investing can be started with any amount of money in your hand and an early start to investment is always desirable. You can start your investment by investing a small investment like 50,000. In this article, we would focus on how can you get return from your short term investment in a smart way by looking at the best short term investment options available to you-

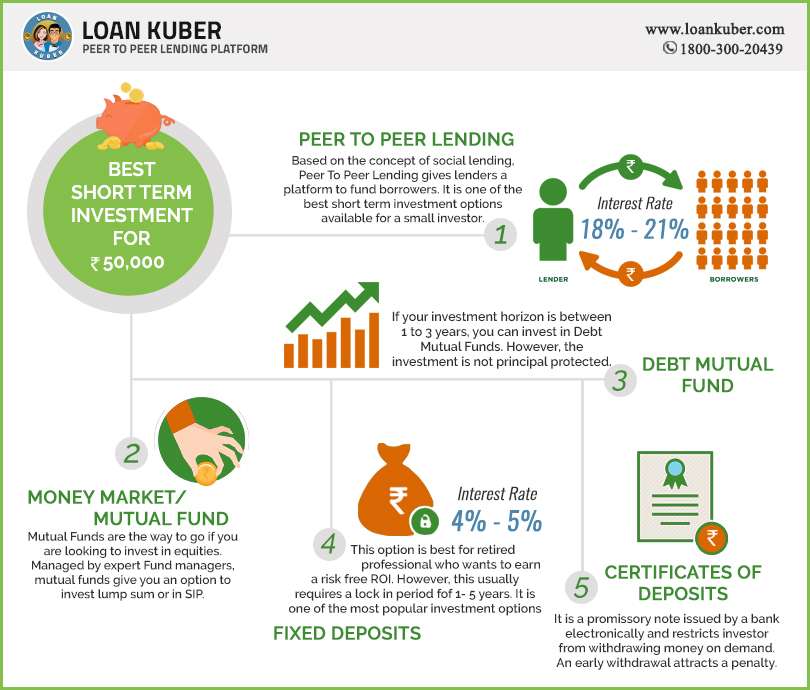

- Peer to peer lending – Peer to peer lending is based on concept of social lending. In peer to peer lending, group of lenders fund a borrower through crowd funding. It is one of the best short term investment options available for a small investor who wants to invest a small amount like Rs 50,000. Peer to peer lending platforms have

given a return of 18% to 21% for tenor between 18 to 36 months. You should consider short term investment option for sure. You can easily get a return that can beat any other investment class including equities.

given a return of 18% to 21% for tenor between 18 to 36 months. You should consider short term investment option for sure. You can easily get a return that can beat any other investment class including equities. - Money market/Mutual fund – If you want to invest a small amount of money in equities then you can take mutual fund route for investment. Mutual funds are professionally managed by expert fund managers. You can invest in mutual fund in lump sum amount or through SIP. You can invest a very small amount like Rs 50,000 in monthly SIP of Rs 5,000 and this will make up your best short term investment plan.

- Debt mutual funds – You can also consider debt mutual funds, if your investment horizon is between 1 to 3 years. However, the investment is not

principal protected i.e the investment value is subject to interest rate risk.

principal protected i.e the investment value is subject to interest rate risk. - Fixed deposits – This investment option is best for retired professional who wants to earn a risk free ROI but not recommended for working professional as the absolute returns of 6-8% hardly beats inflation. However, fixed deposits usually require a lock in period for your investment. It is usually between 1 year and 5 years. Fixed deposits is one of the most popular investment options available to a investor in India.

- Certificates of deposits – It is a promissory note issued by a bank. A CD is issued electronically and restricts user from withdrawing money on demand. For an early withdrawal of money before maturity will attract a penalty that is equal to specified amount of interest.

Investing is a healthy habit and should start investing as early as possible to generate good returns. Investing is a habit that can compound your money, however small it is, in time if invested in a prudent and logical manner. Currently, according to us and many experts peer to peer lending is one of the best short term investment option with a small corpus in hand.