Q1. Why is it important to improve your cibil score?

Q1. Why is it important to improve your cibil score?

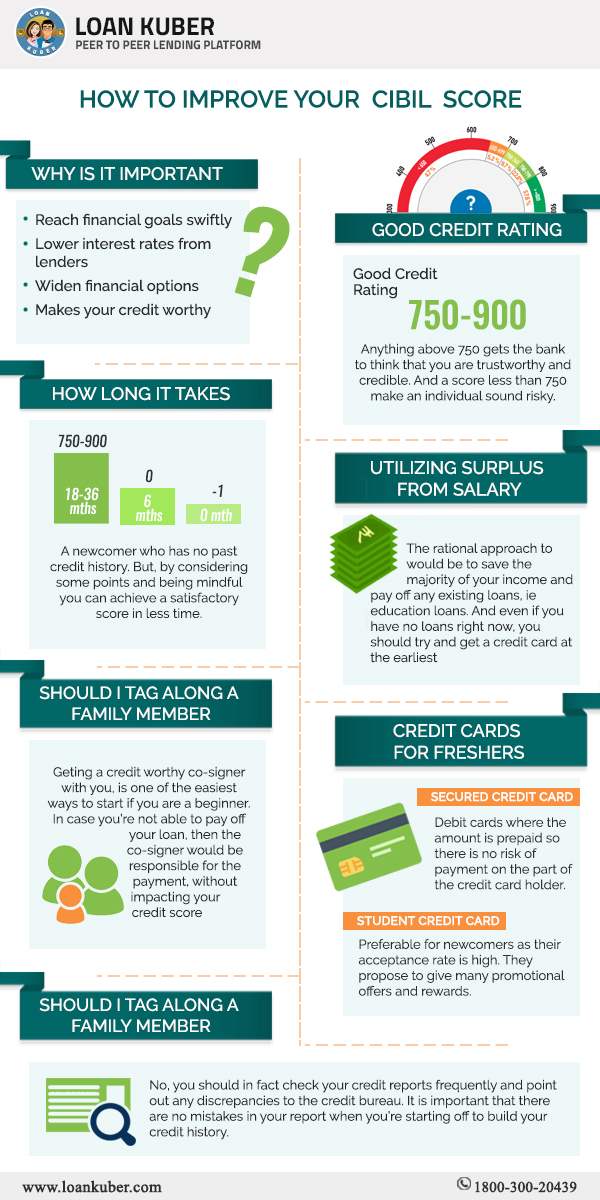

Ans. A good credit rating widens your financing options and you could avail loans effortlessly. This will help you to reach your financial goals swiftly as the hindrances are getting eliminated. The lenders seeing your history could be convinced to offer you better loans with low interest rates. And as a fresher, an individual should play very mindful and always try to not default any payments so that the credit rating is not hampered.

Q2. What is considered a good credit rating?

Ans. A good credit rating ranges from 750-900. Anything above 750 gets the bank to think that you are trustworthy and credible toward your payments. And a score less than 750 make an individual sound risky to the lenders.

Q3. How long does it take and how to improve your cibil score?

Q3. How long does it take and how to improve your cibil score?

Ans. For a newcomer who has no past credit history, the score is usually -1. And on a normal pace till 6 months, the score is 0. So it takes a fair amount of time (almost 18 to 36 months) to build up a constructive and trustworthy score. But by considering some points and being mindful you can achieve a satisfactory score in less time.

Q4. How should I utilize any surplus from my initial salary?

Ans. The rational approach to would be to save the majority of your income and pay off any existing loans, ie education loans. And even if you have no loans right now, you should try and get a credit card at the earliest.

Q5. Should I tag along a family member for loan?

Q5. Should I tag along a family member for loan?

Ans. Get a credit worthy co-signer with you, this is one of the easiest ways to start off when you are a beginner. In case you’re not able to pay off your loan payments for any foreseen reason, then the co-signer would be responsible for the payment, without impacting your credit score The banks would agree to offer you loan seeing a responsible and credit worthy co-applicant with you, which otherwise you wouldn’t have been able to avail.

Q6. What are the credit cards that I as a fresher can get easily?

Ans. The card options are-

– Secured credit cards- These cards are like debit cards where the amount is actually prepaid so there is no risk of payment on the part of the credit card holder. Usually, anyone can qualify for these cards as there is a mandatory cash deposit.

– Student credit cards- These are preferable for newcomers as their acceptance rate is high and they propose to give many promotional offers and rewards.

Q7. Will checking my credit report adversely impact my score or improve your cibil score?

Q7. Will checking my credit report adversely impact my score or improve your cibil score?

Ans. No, you should in fact check your credit reports frequently and point out any discrepancies to the credit bureau. It is important that there are no mistakes in your report when you’re starting off to build your credit history.