Real estate investments are usually considered to be one of the best investment options in India. However, It is a misconceived that you can double your investment in 5 years with a small investment in property. Real estate investment is one of the most illiquid investments with high transaction costs – both at the time of investing and at the time of exit. In fact, more than 90% of investors who have invested in real estate over the last 3 years have suffered significant markdown and are desperate to exit.

Real estate investments are usually considered to be one of the best investment options in India. However, It is a misconceived that you can double your investment in 5 years with a small investment in property. Real estate investment is one of the most illiquid investments with high transaction costs – both at the time of investing and at the time of exit. In fact, more than 90% of investors who have invested in real estate over the last 3 years have suffered significant markdown and are desperate to exit.

In contrast, peer to peer lending companies in India offers superior returns and is much easier investment. Let us look at comparison between real estate investment and P2P lending –

- Risk – With huge fluctuations in real estate prices in India, investing in real

estate is a highly risky option particularly as it is not possible for average person to build a diversified portfolio. On the other hand, peer to peer lending platforms offers to invest in a portfolio of borrowers who are pre screened by platforms form large set of borrowers.

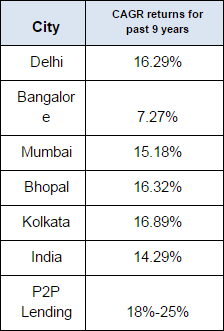

estate is a highly risky option particularly as it is not possible for average person to build a diversified portfolio. On the other hand, peer to peer lending platforms offers to invest in a portfolio of borrowers who are pre screened by platforms form large set of borrowers. - Absolute returns – Generally, it has been observed that investors have misconception that you can double your money by investing in real estate. Even if your property has doubled in 5 years in real terms returns from these investments is only been 15.2% on CAGR annually. Whereas, P2P lending can offer you returns upwards of 18% to 25% annually. Let us look at returns in various Indian cities v/s Peer to peer lending returns-

-

Volatility of Returns – Investing in real estate investments is a highly speculative activity considering current scenario. No one can predict the future scenario for real estate in India with certainty. Whereas, Peer to peer lending companies in India is going to explode as it offers a predictability of returns which are higher than most real estate investments.

Volatility of Returns – Investing in real estate investments is a highly speculative activity considering current scenario. No one can predict the future scenario for real estate in India with certainty. Whereas, Peer to peer lending companies in India is going to explode as it offers a predictability of returns which are higher than most real estate investments. - Liquidity – Liquidity is a major concern in real estate investments as it takes long time to exit the investment particularly in today’s market conditions and entails incurring transaction costs in contrast most peer to peer lending platforms offer secondary market liquidity to their investors.

- Diversification – It is very challenging for most people to have a diversified real estate portfolio as one needs to invest large amount of money in real estate investment which for majority of people is entire amount of life time savings.

- Ease of investment – Real estate investment is a time consuming activity. You need to track various

government notifications and circulars regarding your property. Moreover, real estate investment is a highly documented process. You need to complete all paperwork before buying a property. Whereas, with cutting edge P2P lending platforms investing is just a click away.

government notifications and circulars regarding your property. Moreover, real estate investment is a highly documented process. You need to complete all paperwork before buying a property. Whereas, with cutting edge P2P lending platforms investing is just a click away.

It is clearly seen from the above points that investing in Peer to peer lending companies in India is much better option compared to real estate investment. P2P is going to be one of the most sought after investment options in coming future and you should surely give a shot.