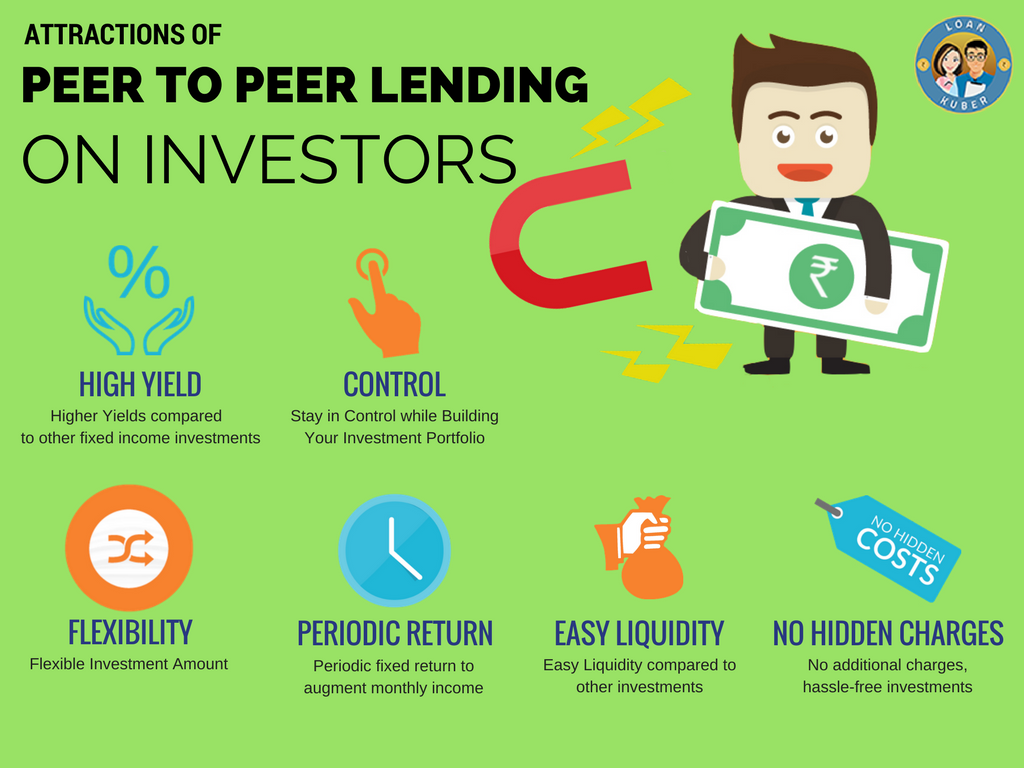

Higher Yields compared to other fixed income investments

Higher Yields compared to other fixed income investments

The yield from Peer to peer lending is much higher as compared to other fixed income investments. Usually, the interest rates range between 16% and 24%. Investor/Lender can earn higher interest than bank FD, stocks or any other investment.

Periodic fixed return to augment monthly income

Investor/Lender gets regular cash flow from Peer to peer lending as they receive a fixed amount regularly in the form of EMI’s which includes high interest plus capital. It compares favorably with Real estate or Stock investments, where the return is blocked till the maturity period.

Stay in Control while Building Your Investment Portfolio

Peer to peer lending platforms offer an option to select where to invest, unlike mutual funds. The lender can go through the profile of the borrower and select on the basis of credit history, amount of loan, interest rates, etc.

No additional charges, hassle-free investments

The credit and other background checks on the borrower is already done by the  Peer to peer lending platforms and uploaded on their website. The lender just has to select pre-screened borrowers according to her risk/return, to build a diversified portfolio.

Peer to peer lending platforms and uploaded on their website. The lender just has to select pre-screened borrowers according to her risk/return, to build a diversified portfolio.

Flexible Investment Amount

There is no minimum amount fixed in Peer to peer lending. Different Peer to peer lending sites have their respective minimum amount that needs to be invested. And the minimum amount is as low as 10,000 rupees in many sites.

Easy Liquidity compared to other investments

Most platform provides the flexibility to the lenders to assign the loan amount to another lender thus facilitating  liquidity ( if required) by the lender. Also by diversification across loan tenors, a lender can optimize his average investment holding period.

liquidity ( if required) by the lender. Also by diversification across loan tenors, a lender can optimize his average investment holding period.