Q1. What is Short term investment plans?

Q1. What is Short term investment plans?

Ans. Investment plans that carry a maturity period of less than or equal to a year are usually considered as short term investment plan.

Q2. What are fixed deposit investments?

Ans. Fixed deposits are investments provided by banks and they offer a high rate of interest. Usually a person prefers to open a fixed deposit account by depositing a particular sum of money for a longer period of time, for example: three to five years. But even fixed deposit accounts can also act as a good short investment plans sometimes as they do offer a good rate of return over the deposits. Nowadays banks have started to offer good FD schemes with a maturity period of 6 months and 1 year and they usually offer a rate of return of up to 9% and therefore can prove to be a very good option regarding a short term investment.

| BANKS | DEPOSIT | TENURE | RATE OF RETURN |

| Punjab National Bank | 2,00,000 | 1 year | 8% |

| IndusInd bank | 2,00,000 | 1 year | 7.75% |

| IDBI bank | 2,00,000 | 1 year | 7.50% |

Q3. What are liquid funds?

Q3. What are liquid funds?

Ans. Liquid funds are basically mutual funds that invest in money market liquid assets. Liquid funds can be converted into cash very easily, and usually offer a maturity period of less than a year, the typical rate of interest offered by liquid funds is usually between 4% to 10%, which is relatively higher and plus they carry a very low rate of risk factor which ultimately makes them one of the best options for a short term investment.

Q4. What is peer to peer lending?

Ans. Peer to Peer lending is a stage, specifically constructed on an online platform where the borrowers can meet the lenders and ask for financial aid, which they have been denied from other financial intermediaries. P2P lending ventures have low overheads, so in return they charge a lesser rate of interest. Here, the P2P lending companies bring in a number of lenders and ask them to invest in the borrowers who are in urgent need of money and in return these lenders receive a good rate of return on their investment as well. Moreover, by offering a certain percentage of the total amount that is required by the borrower, they save themselves from incurring huge losses in the future. Therefore, making P2P lending a good option for short term investments.

Q5. What are fixed maturity plans?

Ans. Investors can invest in FMP’s which carry a maturity period of one year. The ultimate motive behind investing in an FMP is that they actually offer a very good rate of return and easy liquidity. The rate of return is usually around 9.5% and this plan has a minimal presence of any risk factor.

Q6. What is savings account?

Investing in a savings account is usually solely situated with the motive of securely depositing your money in your savings account periodically and receiving nominal rate of return on your deposit. However, with the great flexibility present in maintaining a savings account, one can deposit and withdraw money from their account as per their requirement any day and any time, therefore if one deposits a good amount of money in her/his savings account, she/he will eventually receive a good rate of return on it and with the absence of any sorts of maturity period she/he can easily withdraw money from their savings account as per their need. Therefore, making a savings account seems the most liquefiable short term investment of all time.

| BANKs | DEPOSIT | RATE OF RETURN (P.A) |

| AXIS Bank | For all amounts | 4% |

| IndusInd bank | 1,00,000 | 4,75% |

| HDFC Bank | N.A | 4% |

Q7. What are short term debt funds?

Q7. What are short term debt funds?

Short term debt funds are another kind of an investment with a maturity period of less than a year. These kinds of funds usually include investing in Government securities and cash and money market. There is almost no risk involved in such kind of funds as the risk of default by the government is NIL. However, not all kinds of short term debt funds are risk free such as corporate bond funds, which involve a very high factor of risk, but at the same time also offer a good rate of return on the investment.

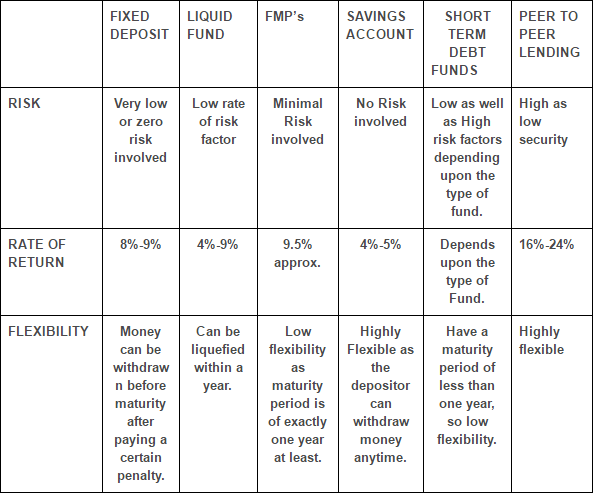

Q8. What are the factors for selecting the right investment option?

In order to invest in a good short term investment plan or to pick the best one out a few factors must always be put into consideration such as calculating the amount of risk involved, the amount of money that needs to be deposited, the term of maturity or liquidity and the return on deposit- which is the most important factor of all because the most amount of interest received the more our investment will shine out.